By Gunaprasath Bupalan (Emjay Communications / The Malaysian Global Busines Forum / News Hub Asia / iHaus / Property360Digest)

With limited access to legitimate financial assistance, the B40 and M40 groups are more often than not caught in a vulnerable position.

Being a journalist for the past 19 years, I have been invited for thousands of press conferences, events, conferences, round table discussions, seminars, forums, so on and so forth. Some companies even tend to spend obscene amounts of money to create an unforgettable atmosphere in the hopes that the journalists that are present write good stories for them.

Initially, all these glam and aesthetics appealed to me too but after the first few years, as experience kicked in, the fluff, flamboyance and lux of the event doesn’t seem to appeal any longer. Instead, the key messages delivered and the notion of the company, service or product tends to take precedence.

I recently received an invitation for a press conference from GoodKredit Malaysia (GoodKredit) for a press conference to be held on 23 April 2019. Even though I had a very vague understanding of the company and its services, I decided to attend the function – main reason was to understand more of the service as it sounded a little intriguing.

At the event, there was no fluff, there was neither massive impressing nor a luxurious set-up but their deliverance was apt – it was a genuine solution for the undue financial pressure on the B40 and M40 groups in Malaysia.

Being the country’s first automated short-term micro-loan provider, GoodKredit’s objective is to empower Malaysians in need of urgent funds with a quick financial solution, utilising state-of-the-art technology and credit scoring algorithms via mobile devices. Intrigued yet?

I found this service to be unveiled in the nick of time. In an economic climate like we are in at the moment, many people need some aid financially, however options are limited. For many people who currently find themselves in a pickle, and need that extra boost to sort things out, they need to apply for a bank loan (which is almost unachievable for those who do not have stacks on money piled up in the bank) or to visit a loan shark aka licensed money lenders. Even though the latter could sort out the immediate problem one is facing, but due to the hefty interest rates and harsh collection methods, it could pose much problems in the future.

This is where GoodKredit steps in. They act as an alternative to the traditional loan platforms. The GoodKredit mobile app is designed to empower eligible Malaysians with a short-term micro-loan solution to address their financial situation.

“GoodKredit is here to make lending more efficient, scalable and an option to those truly in need. This is a huge untapped opportunity for us to empower Malaysians who are facing unanticipated needs and less able to access the traditional financial systems. GoodKredit offers the financially undeserved, speed to meet emergencies for needs…not wants”, said Cheok Tuan Oon, CEO of GodKredit.

At the press conference, Cheok stressed that GoodKredit strives to build a more financially inclusive ecosystem that leads to a prudent and disciplined society. He further elaborated that GoodKredit wasn’t born to just provide funds – most importantly, the company was set up to educate the rakyat on financial responsibility.

According to Amelia Tan – Head of brand and communications explained that GoodKredit utilises in-house built technology as well as with other financial information provided through its partnership with CTOS. “GoodKredit would know within 30 minutes whether a loan is approved or has been rejected. Upon approval, funds will be disbursed to the recipient in one working day”, explained Tan.

GoodKredit is now available nationwide and may be downloaded from the Apple App Store and Google Play Store. For more information, surf to www.goodkredit.com.my

Important facts:

- Licensed under the umbrella of Credit Community (Kredit Kominiti) by the Ministry of Housing and Local Government (KPKT)

- Governed by the Moneylenders Act 1951

- Micro-loans offered between RM1,000 and RM10,000

- Repayment tenure of six, nine or twelve months

- Annual percentage Rate (APR) of 18%

- No collateral or guarantor needed

- Apply via mobile app

Services

STAKEHOLDER ENGAGEMENT

BUSINESS INTELLIGENCE

GOVERNMENT RELATIONS

BUSINESS & BROADER MARKET ACCESS

Upcoming Events

‘A WORKING LUNCH WITH NORDIN’: NATIONWIDE TOUR WITH TOYOTA

MGBF Roundtable: Digitalisation of the Food and Beverage Industry

THE SOUTH CHINA SEA: A THREAT OF DISRUPTION FOR BUSINESS?

FOOD SECURITY IN THE BREACH: INDUSTRIALISATION AND WEAPONISATION

MGBF In The News

MALAYSIA GLOBAL BUSINESS FORUM TIES UP WITH SCOUTASIA

MGBF Photo Bank

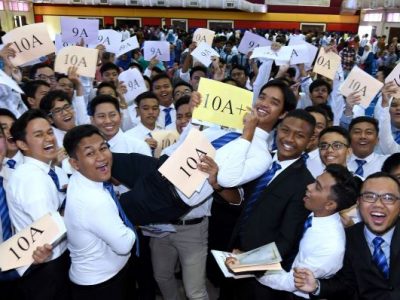

SPM and the Future of Data

MGBF Roundtable to shape Malaysia’s future in the digital economy

MGBF: Political stability to usher in new era for business

Death by a Thousand Algorithms

KSK Land recognised for investor attraction strategy

KSK Land set to drive further investment into Malaysia

A Need for Strategic Calm

With Change Comes Opportunity

MALAYSIA GLOBAL BUSINESS FORUM TIES UP WITH SCOUTASIA

MGBF Photo Bank